Banking Blog

Wholelife insurance

Wholelife/Permanent Life Insurance

It is not wise to talk about Financial MLMs and not talk about the products they sell.

There are tens of thousands of insurance associates who are part of one MLM or other. Almost all of them will sell you a Wholelife Insurance.

What is Wholelife Insurance

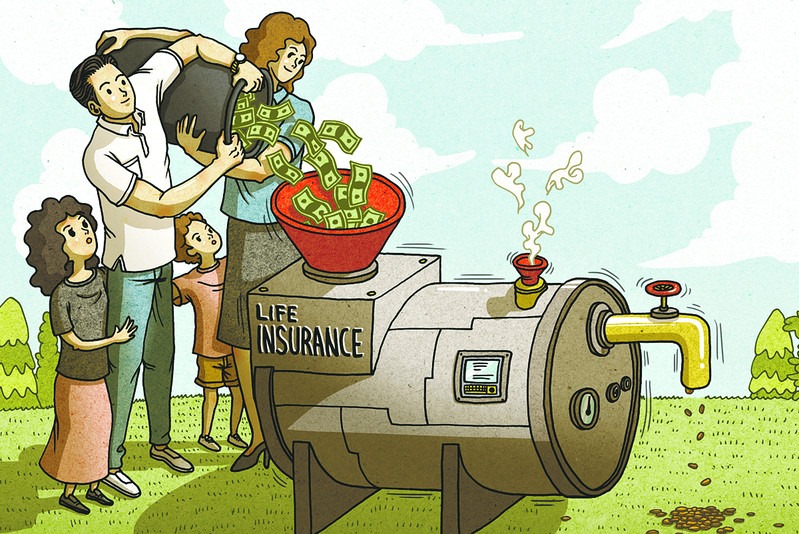

Almost all Wholelife insurance is a mix of insurance and investment. You pay a fixed amount monthly or annually for a fixed period or until you die, the Insurance company will pay your beneficiary.

Why do associates sell Wholelife Insurance?

Short answer - Commissions

Wholelife insurance with a yearly premium of $5000 will pay a commission of around $250-$500 splits between associate who sold you the policy, people in the hierarchy who have added that associate under them and company. Because of this serious conflict of interest, Associates will often put huge effort to sell their product even when term insurance is the best product for you, That’s why almost 80% of the people who buy this product get rid of it before death.

Why Wholelife Insurance is the worst financial product

High Cost

Premium you pay for insurance is split between fee for insurance, commission for associates, management fees and meagre amount accumulates as cash value. You would be better off buying term insurance and invest the difference in TFSA/RRSP.

Lack of Liquidity

You cannot take money out of Whole Insurance before a certain period (say 20 years). But they will let you borrow against cash value you accumulated and will pay interest on the borrowed money. What kind of black magic is that make people borrow their own money and pay interest on it?

Poor Returns

Returns from Investment portion of WholeLife insurance gets you meagre returns when adjusted for inflation. If you ask an associate how does it work? They cannot answer in a text. They say it’s super complex and need to get over call to talk about. Complexity favours the issuer and his salesman, not the buyer. They will say it is guaranteed 6% return on investment. But it is not on the entire amount but only on the cash value(meagre value after all deductions for insurance/fees/commissions). In reality, you will earn less than 2% over the life of the policy.

Lack of Transparency

Ask the associates where the money is invested, which stocks/bonds/real estate? They wouldn’t know. They will pull in all sort of complex words like a Futures market, Exclusive bonds, Segregated funds which are not available to the general public. But in reality Insurance products have invested 67% in bonds (with meagre returns), 13% in stocks, 8% in mortgages, 1% in real estate, 2% in loans to their policy owners, and about 9% in cash and misc. Now you know why they get you meagre returns.

Most of us don’t need Wholelife insurance

Most of us only need term insurance (which is 10 times cheaper) for 20-30 years when you don’t have much savings/investments and after that, your investments/savings will make you self insured. Money in your TFSA can be transferred to your spouse’s TFSA or encashed to your kids tax-free.

So Wholelife insurance is good for no one?

Wholelife insurance might be needed for people with huge illiquid assets such as business, farms and real estate and people with a disabled child who will always be financially dependent.

All these reasons make Dave Ramsey say Wholelife Insurance is worst Financial product. it is like Payday loan for the middle class and people who sell it should be ashamed of themselves.

In short, Buy term insurance and invest the difference in passive funds such as VEQT.

This post may contain affiliate links. Please read our disclosure for more info