Banking Blog

Busting Investing Myth Series - I am too young to start Investing

Busting Investing Myths Series

7) I am too young to start Investing

I know it seems almost impossible to start investing when you are young. You might have student debt, might not have well paying job, You will have lot of upcoming expenses, You finally got some money that you want to spend on things you always want to buy but couldn’t afford earlier.

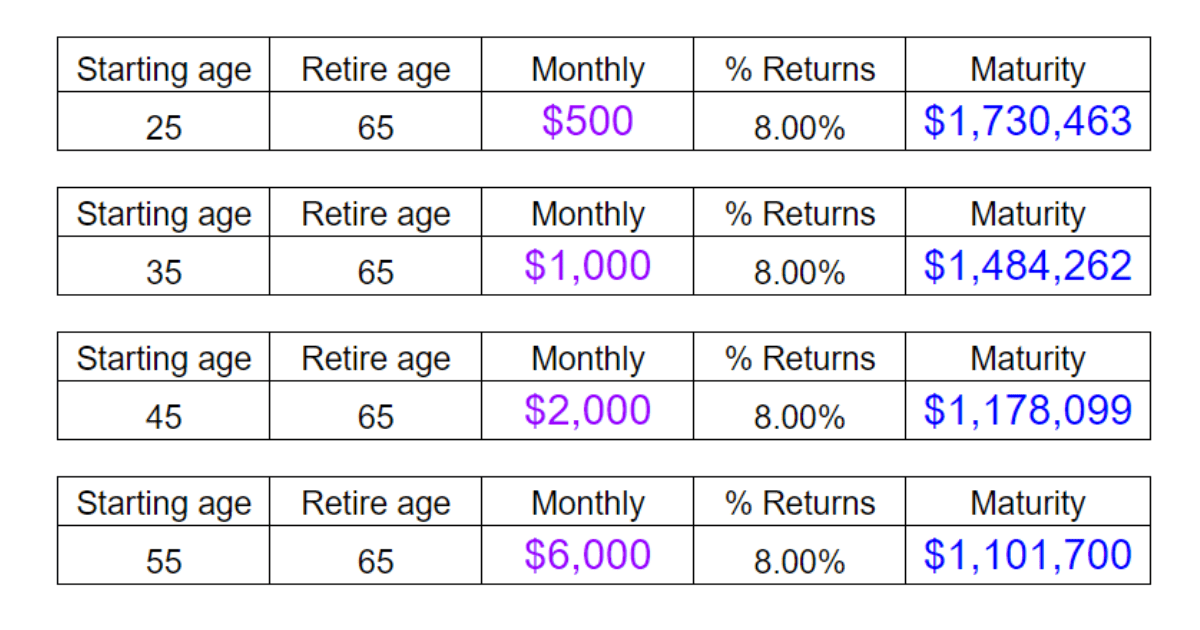

But if you could save some money, It’s better to start investing. Being young, you have one thing which rest of the population doesn’t have - TIME Compound Interest has three main factors. Money you can invest per month, return percentage and number of months you can stay invested(Time).For most of us, We don’t have control over how much we can afford to invest per month and how much returns our index fund will give per month. Only option we have is how soon we can start investing and how long we can stay invested. Table in this post shows how easy is to reach retirement nest egg of $1.7 Million by investing $500 per month on index funds starting at the age of 25. Same become difficult if we start very late.

This post may contain affiliate links. Please read our disclosure for more info