Banking Blog

Vanguard ETFs for RRSP/TFSA

Vanguard All-in-one asset allocation ETFs offer much needed simplicity, diversity and self-balancing portfolio with just 0.22% fees. ( Compared to 1-2% fees with mutual funds). These asset allocation ETFs have everything an investor needs in a single ETF.

All-in-one ETFs are funds of funds that offer global diversification across Canadian, U.S. and international markets, low fees and automatic rebalancing, meaning that investors don�t have to worry about re-aligning their portfolio to maintain their desired value split among different types of assets despite price fluctuations.

Investing in an all-in-one ETF for retirement is like turning your registered retirement savings plan (RRSP) or tax-free savings account (TFSA) into a low-cost professionally managed portfolio.

Based on your risk tolerance, you can pick from All Equity to Conservative portfolios.

All Equity - Vanguard All-Equity ETF Portfolio (VEQT) Investment objective and strategy: Seeks to provide long-term capital growth by investing primarily in equity securities.

100% Equity

Risk rating: Medium.

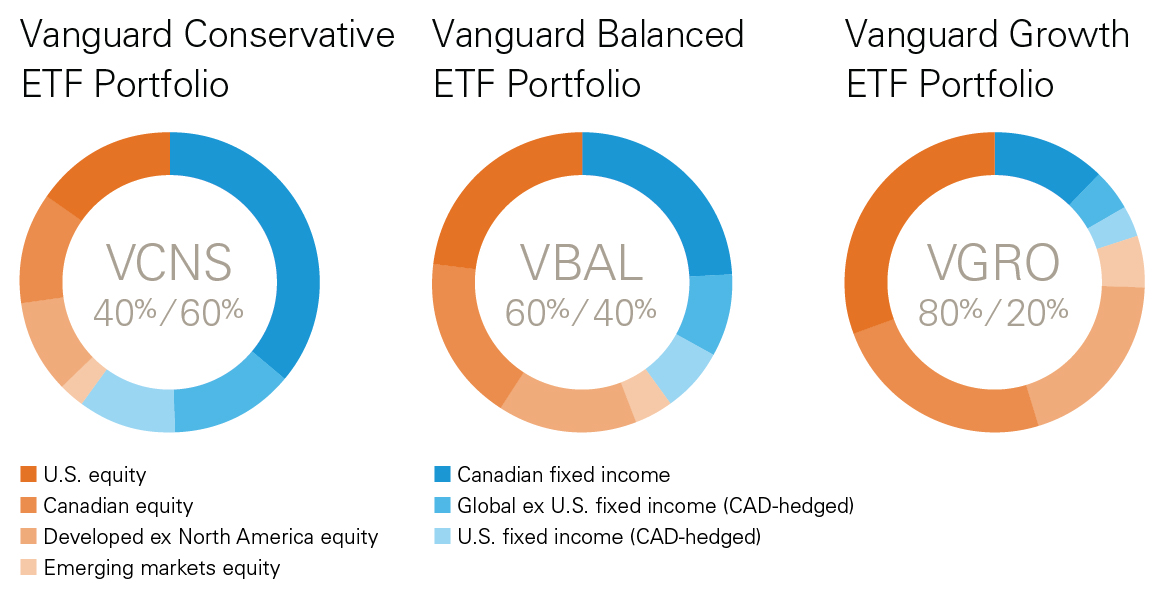

Aggressive - Vanguard Growth ETF Portfolio (VGRO) Investment objective and strategy: Seeks to provide long-term capital growth by investing primarily in equity and fixed income securities.

80% equity + 20% bonds

Risk rating: Low to Medium.

Balanced - Vanguard Balanced ETF Portfolio (VBAL) Investment objective and strategy: Seeks to provide long-term capital growth with a moderate level of income by investing primarily in equity and fixed income securities.

60% equity + 40% bonds

Risk rating: Low to Medium.

Conservative - Vanguard Conservative ETF Portfolio (VCNS) Investment objective and strategy: Seeks to provide a combination of income and moderate long-term capital growth by investing primarily in equity and fixed income securities.

40% equity + 60% bonds

Risk rating: Low.

Conservative Income - Vanguard Conservative Income ETF Portfolio (VCIP) Investment objective and strategy: Seeks to provide a combination of income and modest long-term capital growth by investing primarily in equity and fixed income securities.

20% equity + 80% bonds

Risk rating: Low.

How to buy Vanguard ETF

Vanguard ETFs can be purchased through a self-directed brokerage account such as Questrade.

Use my QPass key: 456224574408149 while signing for Questrade and get upto $50 bonus.

This post may contain affiliate links. Please read our disclosure for more info