Banking Blog

Motusbank - New digital bank offering High interest savings and Low interest loans

Motusbank is new online only bank in the market offering No fee chequing account, High interest savings accounts and Low interest mortgage/personal loans.

It’s continuation of latest trend in banking space in Canada targeted at individuals who hardly visit bank branches and conduct most of their transactions online or through ATMs. Cost cutting made through lack of branches and staff is passed on to the consumers in the form of No fees, High interest for savings account and low interest for loans.

Motusbank , even though new name, it’s not entirely new bank. It’s offered by Meridian Credit Union, which is the largest credit union in Ontario and the third-largest in Canada with more than 337,000 members and over $20.6 billion in assets under management. Motusbank is federally chartered bank in Canada and is a member of the Canada Deposit Insurance Corporation (CDIC).

Accounts Overview

Savings accounts

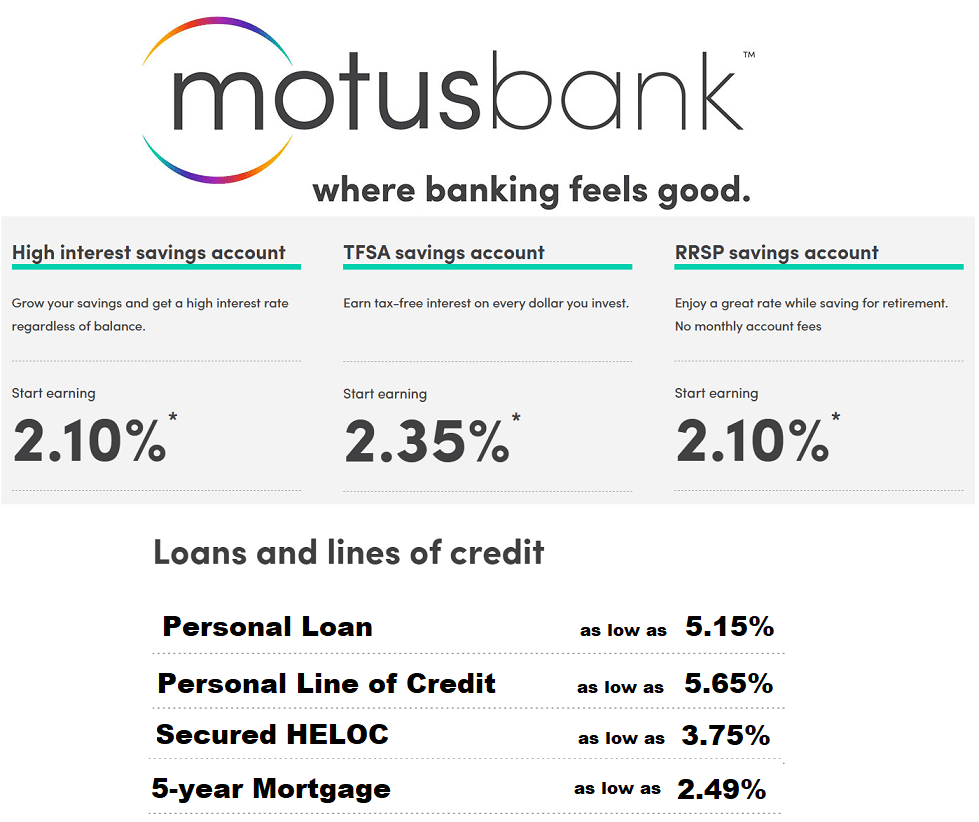

Their savings account and RRSP account offers 1.65% interest where as TFSA account offers 1.85%

In addition to high interests on their savings account, Motusbank offers the following for their savings account

- No monthly fees and no minimum balance requirement

- Unlimited debit transactions and withdrawals

- Access to over 3700 FREE ATMs across Canada via Exchange

- Deposit insurance up to $100K by Canada Deposit Insurance Corporation

They also offer 5-year TFSA GIC and 5-year RRSP GIC at 2.15% interest.

Chequing accounts

Motusbank also offers No fee, No minimum balance chequing account with free unlimited Interac eTransfers and Free 25 cheques. Like their savings account, Chequing account offers deposit insurance upto $100K by CDIC.

Their chequing accounts offer 0.25% interest similar to other online only banks such as Tangerine and Simplii.

Loans

On Loans, Motusbank bank offers

- Personal Loans starting from 5.15%

- Secured Home Line of Credit(HELOC) from 2.95%

- 5 Year Fixed mortgages from 2.49% and 5 Year Variable mortgages from 2.74%.

BankingBlog Thoughts

With arrival of Digital banks, Choice still remains with people on whether they prefer comfort of having the option to walk-in to the branch and talk to someone face to face or take up digital bank account to get rid of outrageously high fees and low interest offered by big banks. Regardless money you deposit into these digital banks are still protected by CDIC upto $100K.

As BankingBlog, recommends setting aside 3-6 months of expenses as emergency funds, Bank like motusbank offers great interest rates to make sure your emergency funds are not eroded by inflation.

This post may contain affiliate links. Please read our disclosure for more info