Banking Blog

Credit scores

Credit scores are rating of how risky is to lend money to you. Ranging from 300-900 points, Higher the credit score, more trustworthy you are.

Credit report can also be checked when you apply for rentals and employment. You might be disqualified from applying for jobs at financial institutions if you have bad credit.

In Canada, credit scores are maintained by two companies. Transunion and Equifax.

As per Transunion, Your payment history makes up 35% of your score, while the amount you owe lenders represents 30%. The length of your credit history contributes 15%, and the types of credit accounts you maintain comprise 10%. Finally, new credit accounts are responsible for 10%.

- 300-599 - Very Poor

- 600-699 - Poor

- 700-749 - Fair

- 750-800 - Good

- 800-900 - Very Good

If your score is good, you will get approved for most of the applications and you will get low interest rate for your loans.

To get better score you should have

1) Longer credit history - This basically tell bank that you are paying all your credit card, phone, loan interest on time for so many years.

2) Credit utilization : This is ratio of money you owe banks and total amount of credit you have. Usually utilization of less than 30% is recommended. So if total credit limit of all your credit cards and line of credit is $10K, Do not go beyond $3K.

3) Credit Mix : If you have variety of loans and paying all bills on time. This increases your score. Credit cards, Line of credit, Fixed term loans, Auto loan, Home mortgage are all different types of credits.

4) Inquiries: If you applying for multiple credit cards and loans in short duration, This might make you look like credit hungry and will impact your credit score. As creditor might think you have bad financial situation.

5) Missed payments: Never miss any of your bills. It doesn’t matter if you missed bill of $4 or $400, it does the same damage. Worse is when you leave it until it goes to collection agency. Set up auto debit for all your credit cards and bills to prevent this. I know someone whose credit score went down by 200 points just because of one missed payment.

What will not impact your Credit score/report

1) Your Income

2) Your Assets such as house/investments

3) Criminal history

4) You checking your own credit report/score

How does Credit Report/Score impact your Eligibility and Interest

Almost all financial institutions have Minimum credit score you need to have to be eligible for their credit products. Other than Credit Score, Your credit history, delinquencies, bankruptcy can impact both your eligibility and Interest on the loans you can get.

Unlike US, Once your credit score is above 700, Any increase in credit score beyond 700 will not reduce your loan interest in Canada.

How to get your Free Credit Score/Report

Transunion

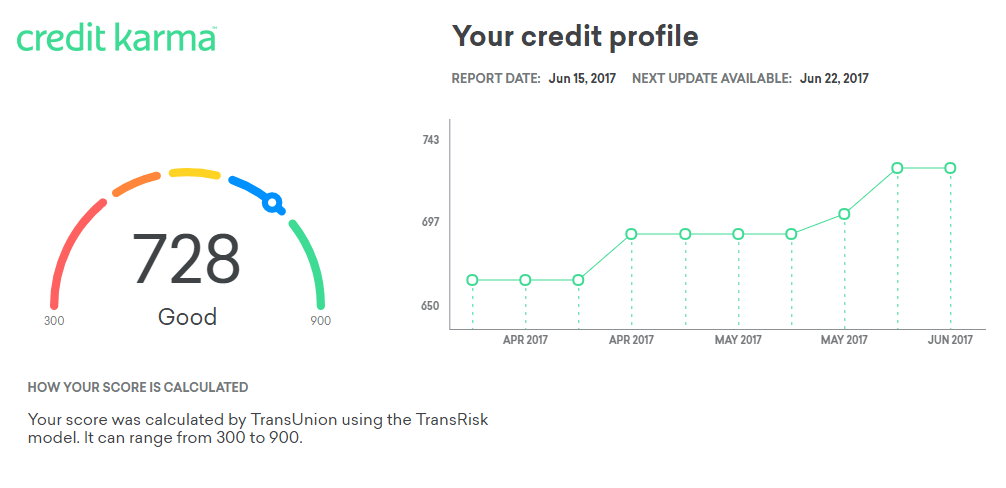

You can now get free Transunion credit score and report through CreditKarma . You can get updated score and report every week.

Equifax

Mogo offers free Equifax Credit score and it also offers free Credit Monitoring for a year. Credit Monitoring is when the service will alert you whenever new inquiry or Account is added to your profile. Downside is you cannot see your report, just the score and alerts.

Signup for Mogo Credit Score/Monitoring

Borrowell

Borrowell offers Equifax Credit Score and Credit Report. You can get an updated score and report every week. Signup for Borrowell Credit Score/Report

This post may contain affiliate links. Please read our disclosure for more info