Banking Blog

Budgeting Basics

Everyone needs a written budget regardless of whether you are living paycheck to paycheck, have a good emergency fund or rich. Budget helps you realize where your hard earned money is draining.

To do budgeting, All you need is piece of paper/pen or Google sheet.

First step of budgeting is to know what is your family’s monthly income (after taxes and other mandatory deductions such as EI)

Next step is to list down all your expenses such as mortgage or rent, utilities, insurance, Car payments, Groceries, discretionary spending such as shopping, dining out, movies, hobbies. I use credit card for most of my expenses, so all I had to do is to take my last month statement.

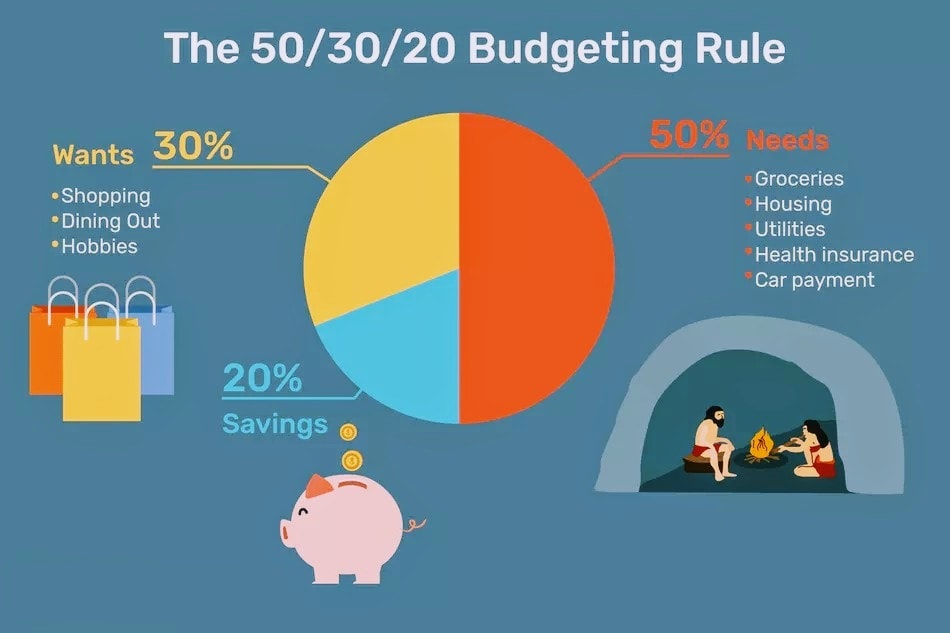

Next step is the important and most tough step, To classify your expenses into two : Needs and Wants

Many get confused here to distinguish between Needs and Wants.

Anything you absolutely need to survive falls under Needs. mortgage or rent, utilities, insurance, Car payments, Groceries, medicines. Being quarantined for couple of weeks will help you understand what are needs.

Coming to Wants, These are expenses that makes your life comfortable, Like shopping, dining out, movies , Netflix, Cable.

There is no strict line separating these two, For someone like me , Car payments fall under wants, For others it will be absolute need. As long as you be logical and label them right, it will help you.

Next steps is add all your expenses under Needs and make sure it doesn’t go beyond 50% of your expenses.

Add all your expenses under wants and make sure it doesn’t go beyond 30% of your expenses. Remaining 20% should be used to build up emergency fund.

This is just general guidance, Depending on your situation, You can reduce your wants to either pay back the debt or build up emergency fund.

When I had debt, I cut my wants to 5% and put everything else to repaying debt.

This post may contain affiliate links. Please read our disclosure for more info