Banking Blog

All about Life Insurance

What is Life Insurance ?

As the name says, It is insurance on your life, it can cover you for fixed term or entire life. You can pay either monthly or yearly and Company will pay your beneficiaries on your death.

Why Life Insurance ?

If your loss affects your family financially, then getting a life insurance is not an option anymore. It gets even more important if you are the only earning member in the family or if you have mortgage/other debt which can eat away your savings. Life Insurance makes sure your family doesn’t suffer financially and your kid’s education continues in case of a mishap.

Life Insurance Options

There are multiple life insurance options - Term insurance, Wholelife and Universal life insurance. While Wholelife and Universal life insurance are permanent policies i.e it covers you for your entire lifetime, Term insurance covers you for a fixed term 10,20 or 30 years with options to renew at the end of the term. Unlike Wholelife/Universal policy, It doesn’t have any investment portion and it doesn’t pay you/nominee anything if you outlive your insurance term.

Why Term Insurance ? Term insurance is cheap: For an equal coverage Wholelife insurance premiums are approximately 5 times that of term insurance. Which means, You can invest the difference in any assets you prefer and your investments will have better liquidity and transparency. You will not need life insurance of your entire life, Say 30 years from now, Your family will not depend on your income as your savings/investments will act as your insurance and will support your family.

How much Insurance you need ?

This changes from person to person depending on your monthly expenses and number of dependents. Usual suggestion is ten times of your annual income. But I would suggest multiplying your annual income with number of years left until your retirement.

Where to buy Term Insurance ?

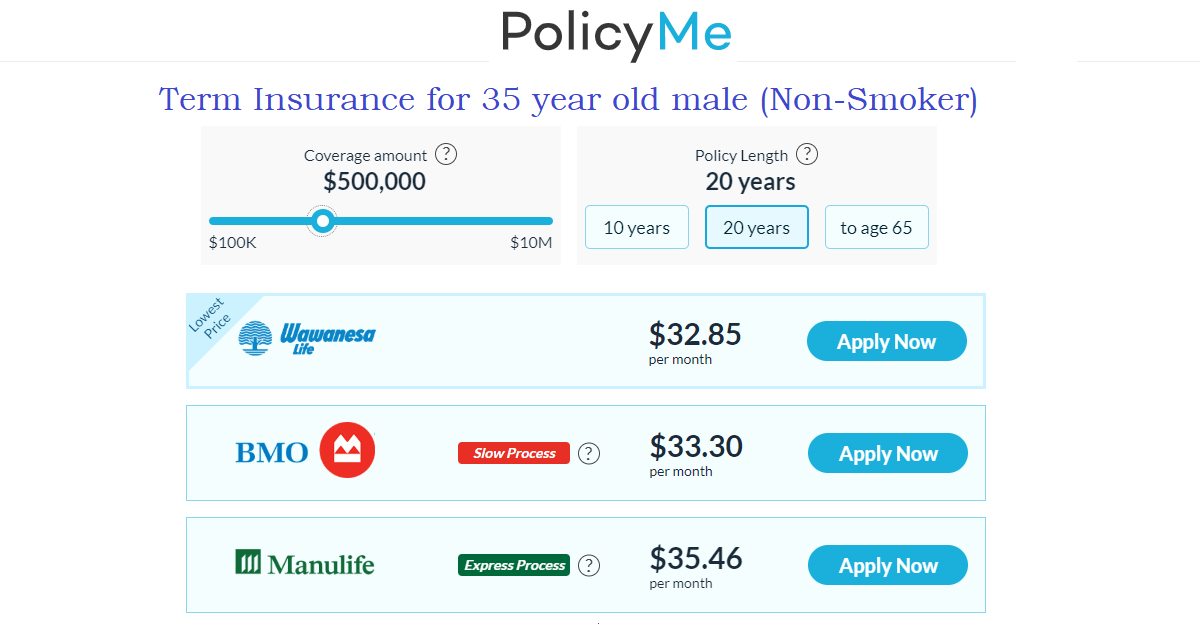

Instead of going to single bank or insurance provider, it is better to shop around to get best price. Even $10 savings per month if invested over 30 years in index funds can get you $10K. I used PolicyMe for my life insurance as it uses easy online form to understand your situation and suggest you the best term insurance rates from multiple insurance providers in Canada by its monthly premium.

This post may contain affiliate links. Please read our disclosure for more info